It does not matter at what price you buy a stock. What matters is what price you sell the stock.

The price at which you can enter a stock position is not under your control. At one time Google was 200 and now it is $500. Even if I want, I can not buy it at 200. The entry price is not under my control.

However, once you buy it, you can sell at any time you want. The price at which you will sell will determine whether you have made a profit or a loss. You can sell it now, you can sell after 2 weeks.or whenever you want.

That is why, the placement of stops is very important.

There are two ways of placing stops:

1. Volatility Stops

2. Stops at nearest Support or Resistance.

DreamTai uses Volatility Stops.

It calculates the average range a stock moves per day and stops are placed at 3 or 4 times the average range in order to give it some space to move.

Here, let me explain with the help of an example. Look at the stock OMG. We had recommended buying it on September 29, 2006 at 44.37 and asked to place a stop at 37.86 which was the Volatility Stop.

http://dreamtai.blogspot.com/2006/09/dreamtai-stock-trading-software-friday_29.html#links

If instead of Volatility Stop, you wanted to place a Support Resistance Stop, you will place the stop at the nearest support point, which in this case come to be around 36-37. It is safer to place the stop at slightly below the support point, say at 35 to prevent being stopped out by price spikes.

In this case, the Volatility Stop and the Support-Resistance Stop are nearly the same.

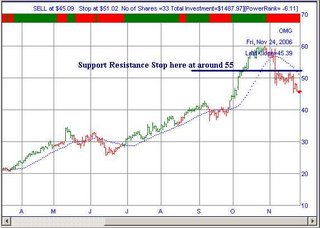

Look the the current chart of OMG. OMG had gone upto 60 and then a SELL signal was issued.

Currently OMG should be shorted. Dreamtai is giving a SELL SHORT at 45.09 and is asking to place a BUY stop at 51.02

Now, here is a QUIZ QUESTION for you. If you want to place a Support Resistance Stop, where would you place the BUY Stop ?

The answer is around 55. The nearest resistance on top is at 52 to 53. So, place a stop slightly higher at 55.

The Volatility stop is better in cases where the stock is strongly trending and has a sudden zooming upwards movement. In that case, the Support Resistance point is very far off. So, it will be better to use the Volatility Stops.

See Google. It has zoomed up to 505. Now, if we use the Support Resistance stop, it comes to be around 470 but if we use Volatility Stop, it comes to be around 492. We can buy more quantity of Google if we use the Volatility Stop.

So, which stop to use ?

It does not matter which stop you use as long as the Risk per trade is less than 2 percent of your equity.

So, the next question is once you enter a position, should you use a trailing stop if the stock moves in your favour ?

Yes, it is always safe to use a trailing stop, but place it at the nearest support or resistance, otherwise, you will be stopped out by a price spike.