Welcome to DreamTai Stock Trading Software blog. Here, DreamTai members can post their views, ideas, opinions and list of stocks which they like and which have given a Buy Signal or Sell signal by DreamTai stock Trading Software.

Tuesday, September 30, 2008

Cheer up: Here comes a recession

Although the huge financial-rescue plan may help Wall Street, there's still plenty of bad news to come in the real economy. History gives us reason for hope, however..

CLICK HERE TO READ MORE ===>

CLICK HERE TO READ MORE ===>

Monday, September 29, 2008

Wall Street, R.I.P.: The End of an Era, Even at Goldman

WALL STREET. Two simple words that — like Hollywood and Washington — conjure a world.

A world of big egos. A world where people love to roll the dice with borrowed money. A world of tightwire trading, propelled by computers.

In search of ever-higher returns — and larger yachts, faster cars and pricier art collections for their top executives — Wall Street firms bulked up their trading desks and hired pointy-headed quantum physicists to develop foolproof programs.

CLICK HERE TO READ MORE==>

Why the Bailout Bill Failed

So how could a major bill described by the president and both parties' leaders as critical to the well-being of the nation's -- and the world's -- economy go down to defeat?

There are no easy answers here, as the House's stunning defeat moments ago of the financial bailout legislation is putting us into seemingly uncharted territory. But while the final tally, with 133 Republicans and 95 Democrats voting no, was a surprise -- all morning, Hill sources were predicting narrow passage -- the signs were there that the measure was in trouble:

CLICK HERE TO READ MORE ==>

There are no easy answers here, as the House's stunning defeat moments ago of the financial bailout legislation is putting us into seemingly uncharted territory. But while the final tally, with 133 Republicans and 95 Democrats voting no, was a surprise -- all morning, Hill sources were predicting narrow passage -- the signs were there that the measure was in trouble:

CLICK HERE TO READ MORE ==>

Do I Hear 4%? On This Site, Banks Bid for Your Cash

IN some bazaars, vendors call out their prices, lowering them on the spot as they vie with one another for a shopper’s business.

That’s the kind of competitive selling — and possible good deals for shoppers — that one new Web site hopes to bring to those looking to invest a nest egg in a certificate of deposit or other savings account at an attractive rate.

CLICK HERE TO READ MORE ==>

That’s the kind of competitive selling — and possible good deals for shoppers — that one new Web site hopes to bring to those looking to invest a nest egg in a certificate of deposit or other savings account at an attractive rate.

CLICK HERE TO READ MORE ==>

Roubini: Why the Treasury TARP bailout is flawed

The Treasury plan (even in its current version agreed with Congress) is very poorly conceived and does not contain many of the key elements of a sound and efficient and fair rescue plan. ...

CLICK HERE TO READ MORE ==>

CLICK HERE TO READ MORE ==>

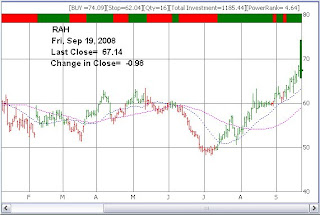

Market status as of Sunday, Sept 28, 2008

The Market is still in a downtrend as the 20 days moving average is below the 50 days moving average.

For more information on how to find the trend, please refer the following link and read the preview section

For more information on the "neck of the dragon" chart pattern, please refer the following link

http://www.dreamtai.com/ebook/

You can preview the book there and purchase it also from that link.

Sunday, September 28, 2008

Sunday, September 21, 2008

Market status as of Sunday September 21, 2008

The market is in a bearish trend at present as the 20 days moving average line is below the 50 days moving average line.

For more information on how to find the trend, please refer the following link and read the preview section

For more information on the "neck of the dragon" chart pattern, please refer the following link

http://www.dreamtai.com/ebook/

You can preview the book there and purchase it also from that link.

Sunday, September 14, 2008

Market status as of Sunday Sept 14, 2008

The market is still trend-less and choppy and flat. Wait till the trend becomes clear.

For more information on how to find the trend, please refer the following link and read the preview section

For more information on the "neck of the dragon" chart pattern, please refer the following link

http://www.dreamtai.com/ebook/

You can preview the book there and purchase it also from that link.

Subscribe to:

Posts (Atom)