Where'd the bailout money go? $350 billion later, banks won't say how they're spending it

WASHINGTON (AP) -- It's something any bank would demand to know before handing out a loan: Where's the money going?

But after receiving billions in aid from U.S. taxpayers, the nation's largest banks say they can't track exactly how they're spending the money or they simply refuse to discuss it.

CLICK HERE TO READ MORE==>

Welcome to DreamTai Stock Trading Software blog. Here, DreamTai members can post their views, ideas, opinions and list of stocks which they like and which have given a Buy Signal or Sell signal by DreamTai stock Trading Software.

Sunday, December 28, 2008

Did anyone Bribe Senate To Pass Bailout Bill?

How much money did your Represenative get from Big Bankers to look the other way and pass a bill that the American people clearly do not want?

HELP SPREAD THE WORD...

http://www.WashingtonYoureFired.com

Brother Can You Spare a Dime? And The Great Depression

The Great Depression

Did You Ever Lose a Million Bucks?

Take a tip from Margaret Shotwell who dispenses advice after losing 1 million dollars in the Wall Street stock market crash on Black Friday, October 28, 1929. Her only possessions are her piano and chinchilla fur

1929 Wall Street Stock Market Crash

The most devastating stock market crash in the history of the United States; from documentary: New York

'Don't Panic, Stocks are Safe!' Haa,Haa,Haa

80 years ago, Economist Professor Irving Fischer explains that the stock market crashed due to high expectations- not high stock prices. Too many speculators were playing the stocks with borrowed money, resulting in a run on the banks.

80 years later, the banks are speculating with borrowed money and investors are running away from them

The Money Masters - How International Bankers Gained Control of America

"The powers of financial capitalism had a far-reaching plan, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole...Their secret is that they have annexed from governments, monarchies, and republics the power to create the world's money..."

THE MONEY MASTERS is a 3 1/2 hour non-fiction, historical documentary that traces the origins of the political power structure that rules our nation and the world today.

The modern political power structure has its roots in the hidden manipulation and accumulation of gold and other forms of money.

The development of fractional reserve banking practices in the 17th century brought to a cunning sophistication the secret techniques initially used by goldsmiths fraudulently to accumulate wealth.

With the formation of the privately-owned Bank of England in 1694, the yoke of economic slavery to a privately-owned "central" bank was first forced upon the backs of an entire nation, not removed but only made heavier with the passing of the three centuries to our day. Nation after nation, including America, has fallen prey to this cabal of international central bankers.

Friday, December 26, 2008

'Dilbert' on how to save your career

As the cartoon turns 20, creator Scott Adams speaks out on boss diversity, where Wall Street went wrong, Dilbert's scary job hunt, and more

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

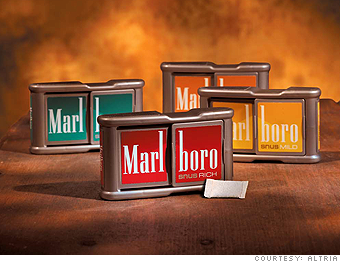

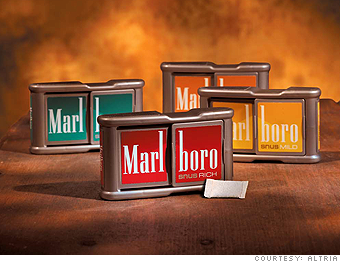

10 stocks to buy now

We're mired in the grizzliest bear market in decades. But the good news is that stocks have been marked down to holiday-sale levels. Here are ten stocks we think are poised for strong returns in 2009 and beyond.

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

Fortune 40: Best stocks to retire on

Our trademark long-term portfolio can help put you on the road to a secure future.

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

Madoff: Lifestyles of the rich and infamous

Bernard Madoff, the man behind an alleged $50 billion fraud, has a yacht named 'Bull,' owns several luxurious homes and may even have had two private planes on call.

CLICK HERE TO LOOK AT HIS WILD LIFESTYLE==>

CLICK HERE TO LOOK AT HIS WILD LIFESTYLE==>

Apple stock should shine again

Whether you should have faith in the shares depends on whether you bought AAPL at about $200 last year, or are contemplating it now at around $85.

As reliable as a holiday fruitcake that shows up season after season, Apple's stock could once be counted on to ride a year-end price bump. The swirl of anticipation for the shiny new gadgets CEO Steve Jobs would reveal at January's annual Macworld product-fest usually gave it a lift. But not this year!!!

CLICK HERE TO READ MORE==>

As reliable as a holiday fruitcake that shows up season after season, Apple's stock could once be counted on to ride a year-end price bump. The swirl of anticipation for the shiny new gadgets CEO Steve Jobs would reveal at January's annual Macworld product-fest usually gave it a lift. But not this year!!!

CLICK HERE TO READ MORE==>

Oracle's edge

The software giant will no doubt feel some pain as companies scale back staff. But its stable infrastructure business will help it weather the storm better than most.

Say what you will about Larry Ellison's style, but the in-your-face founder of Oracle knows how to manage a company through a recession, at least so far

CLICK HERE TO READ MORE==>

Say what you will about Larry Ellison's style, but the in-your-face founder of Oracle knows how to manage a company through a recession, at least so far

CLICK HERE TO READ MORE==>

3 best Web books of 2008

Looking to capitalize on the Facebook revolution? These must-reads show you how.

By Jessi Hempel, writer

This was the year that businesses finally embraced the social Internet, setting up blogs, wikis and other Web 2.0 services. But for all their experimentation, relatively few companies have figured out how to be strategic about these new technologies.

Here's the best of this year's literature for companies obsessed with how to get social media right:

CLICK HERE TO READ MORE==>

By Jessi Hempel, writer

This was the year that businesses finally embraced the social Internet, setting up blogs, wikis and other Web 2.0 services. But for all their experimentation, relatively few companies have figured out how to be strategic about these new technologies.

Here's the best of this year's literature for companies obsessed with how to get social media right:

CLICK HERE TO READ MORE==>

Thursday, December 25, 2008

'Mind-reading' software could record your dreams

Pictures you are observing can now be recreated with software that uses nothing but scans of your brain. It is the first "mind reading" technology to create such images from scratch, rather than picking them out from a pool of possible images.

CLICK HERE TO READ MORE-->

CLICK HERE TO READ MORE-->

Getting Creative with Wall Street Bonuses

Hey, bankers! Got a bunch illiquid, crappy assets weighing your balance sheet down?

Here's a novel idea: Give them to your employees as a bonus. It's better than nothing, right?

That's Credit Suisse's idea, anyway, and kudos to them for solving two seemingly insurmountable problems with one swift move. Bloomberg reports that Credit Suisse will use $5 billion in illiquid debt to pay its top employee's bonuses this year.

CLICK HERE TO READ MORE=>

Here's a novel idea: Give them to your employees as a bonus. It's better than nothing, right?

That's Credit Suisse's idea, anyway, and kudos to them for solving two seemingly insurmountable problems with one swift move. Bloomberg reports that Credit Suisse will use $5 billion in illiquid debt to pay its top employee's bonuses this year.

CLICK HERE TO READ MORE=>

Bernie Madoff discusses the stock market in video from 2007

Bernard MadoffBernie Madoff the (alleged) $50 billion Ponzi scheme maestro discusses the modern stock market in this video. Check out the swooning introduction from the moderator.

Be sure to take note of this line: “By and large, in today’s regulatory environment it is virtually impossible to violate rules… It’s impossible for a violation to go undetected, certainly not for a considerable period of time.”

Be sure to take note of this line: “By and large, in today’s regulatory environment it is virtually impossible to violate rules… It’s impossible for a violation to go undetected, certainly not for a considerable period of time.”

'GOLDEN GOOSE' & THE PINUP:INSIDE-TRADING 'SCAM'

A Lehman Brothers broker master minded a $4.8 million insider-trading scheme, passing on to pals valuable in formation from his high-powered publicist wife, whom he dubbed his "golden goose," authorities said yesterday.

Matthew Devlin, 35, helped make his friends millions through the scheme, which also involved Playboy maga zine's Miss August 1994, the feds said.

CLICK HERE TO READ MORE==>

Matthew Devlin, 35, helped make his friends millions through the scheme, which also involved Playboy maga zine's Miss August 1994, the feds said.

CLICK HERE TO READ MORE==>

Sorry we F$#$ked up your Christmas! But really we do not give a $##t!

A group of British bankers are selling a song on iTunes that has pissed off plenty of people because of its tounge-in-cheek treatment of the financial crisis..

SNEERING bankers have released a record mocking the economic misery facing millions of Britons.

CLICK HERE TO READ==>

SNEERING bankers have released a record mocking the economic misery facing millions of Britons.

CLICK HERE TO READ==>

Monday, December 08, 2008

Be a TRUMP!!

In the shadow of his famous father, Donald Trump Jr. talks about the global meltdown, why some rich people can’t get mortgages, Kazakhstan, and his dad’s ’80s office.

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

The little three beg for Big MONEY!!

It took about nine hours on the highway for the chief executives of the Big Three automakers to arrive on Capitol Hill. It took just a few minutes of questioning from lawmakers for them to realize they might not get what they want.

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

An Artist's Greatest Bricks

Former corporate lawyer Nathan Sawaya has been creating large-scale Lego sculptures for the last several years. This work, entitled Yellow, has become one of his signature pieces. "I guess it's because opening up oneself to the world is not an easy thing to do," Sawaya says.

CLICK HERE TO READ MORE==>

CLICK HERE TO READ MORE==>

NoPod!!

Why America's favorite gadget is doomed.

Take a deep breath, Macaholics. Think different. Apple might be the envy of the technology world right now, yet in its core business of music—iTunes and those beloved iPods—the company is veering toward trouble. Sooner than you think, the iPod as we know it will seem as nutty as a no-down-payment balloon mortgage.

CLICK HERE TO READ MORE==>

Take a deep breath, Macaholics. Think different. Apple might be the envy of the technology world right now, yet in its core business of music—iTunes and those beloved iPods—the company is veering toward trouble. Sooner than you think, the iPod as we know it will seem as nutty as a no-down-payment balloon mortgage.

CLICK HERE TO READ MORE==>

Cheaper Chic!!

With even the rich feeling financially pinched, businesses are quietly offering discounts on everything from spa services to private jets.

The Wall Street stockbroker had used FlatRate Moving, a high-end moving service, a half-dozen times over the years. They moved him from a modest apartment on the Upper East Side to a grander one on the Upper West. He called when he moved to an even better building in Midtown. Most recently, FlatRate helped settle him and his wife and child into a 3,000-square-foot loft in Soho, one of Manhattan's priciest neighborhoods.

FlatRate got another call two months ago. The client was packing up his family for a two-bedroom apartment in the less expensive Park Slope, Brooklyn. He had lost his job and was no longer in a position to pay the $3,000 to $5,000 a month he'd shelled out before.

"We did the move almost at cost"—for under $1,200, says Michael Kessler, FlatRate's vice president of marketing and sales.

CLICK HERE TO READ MORE==>

The Wall Street stockbroker had used FlatRate Moving, a high-end moving service, a half-dozen times over the years. They moved him from a modest apartment on the Upper East Side to a grander one on the Upper West. He called when he moved to an even better building in Midtown. Most recently, FlatRate helped settle him and his wife and child into a 3,000-square-foot loft in Soho, one of Manhattan's priciest neighborhoods.

FlatRate got another call two months ago. The client was packing up his family for a two-bedroom apartment in the less expensive Park Slope, Brooklyn. He had lost his job and was no longer in a position to pay the $3,000 to $5,000 a month he'd shelled out before.

"We did the move almost at cost"—for under $1,200, says Michael Kessler, FlatRate's vice president of marketing and sales.

CLICK HERE TO READ MORE==>

What's a Super-Senior Tranche?

A synthetic bond can behave very much like a real bond.

So consider the situation of a bank, which has made a bunch of loans, to 100 different companies. The companies all value their relationship with the bank, and the bank values its relationship with the companies. At the same time, however, the bank would like to free up some capital. It doesn't want to sell the loans outright -- so instead it creates a synthetic bond referencing those 100 credits, and sells that.

CLICK HERE TO READ MORE==>

So consider the situation of a bank, which has made a bunch of loans, to 100 different companies. The companies all value their relationship with the bank, and the bank values its relationship with the companies. At the same time, however, the bank would like to free up some capital. It doesn't want to sell the loans outright -- so instead it creates a synthetic bond referencing those 100 credits, and sells that.

CLICK HERE TO READ MORE==>

The Mansion: The Subprime Parable

When Michael Lewis and his family move into a house they can't afford, he gets a taste of the new American nightmare.

CLICK HERE TO READ MORE ==>

CLICK HERE TO READ MORE ==>

Subscribe to:

Posts (Atom)