(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

WHAT IS THE MEANING OF GOING LONG AND COVERING YOUR LONG POSITIONS ?A stock represents a share in a company. If you buy 100 stocks of Microsoft, it means that you are a part owner of Microsoft.

Of course, that does not mean that you can go and tell Bill Gates how to run this company.

That is because you just have 100 stocks of Microsoft. There are millions of shares of Microsoft traded in the stock market.

If you purchased a sizable amount of stock and become one of the major stock holder of the company, then you can meet the management and influence the company policies.

But that is usually not the reason you purchase stock.

Usually you purchase stocks in the hope that the price of the traded stock goes up and you can sell it to someone else at a profit.

Suppose you notice that the stock of Google is moving up.

At present, assume that the price of a Google share is $350.

You think that this stock may go up.

So, you call your stock broker or go to his web site and place a order to purchase 10 shares of Google for a total cost of $ 350 x 10 = $ 3500 This purchasing of stock is also called

GOING LONG. So, you are

LONG ON GOOGLE now which means you have purchased some shares in Google.

So, from your brokerage account, $ 3500 will be subtracted and you will be the proud owner of 10 shares of Google.

You track the price of Google every day. You have great hopes for this stock. Some day the stock price moves up by $20 and you are really happy.

Some day, the price of stock decreases by $ 30 and you are sad.

Let us say after some time, you decide to sell your shares of Google. May be, you need the money or Dreamtai gave a Sell signal or some friend warned you that the market is going to crash and it is safe to sell all your stocks now.

Suppose the price of Google now is $ 400

Since you purchased 10 shares of Google for $ 350 and now you are selling it for $ 400, you are making a profit of $ 400 -$350 = $ 50 per share, that is $ 50 x $ 10 = $ 500 for ten shares.

You ask your broker to sell the shares of Google. So,your broker will sell the stock for a total of $ 4000 and that amount ill be deposited in your brokerage account.

Now, you will have zero shares of Google and $ 4000 deposited in your bank account.

This process of selling your existing shares is called

COVERING YOUR EXISTING LONG POSITIONS.Previously, you were long on Google but now, you have covered your long position.

Now, you do not have any stocks. but you just had $ 500 gain by trading in stocks.

Here is how DreamTai would have helped you for buying and selling Google stock.

You would check Google stock in DreamTai every day.

One day around mid - October , you notice that when the stock is at $ 350, the three conditions for BUY signal are fulfilled in Dreamtai:

1. Dotted Average Line Sloping up

2. Stock Price Above Dotted Average Line

3. Stock Price bar is Green color

You would have purchased Google and then checked Google stock chart in Dreamtai every day.

One day you notice (around mid November 2005), that the Google price bar is painted RED color. This means, you have to cover your long.

and sell your existing positions.

WHAT IS THE MEANING OF GOING SHORT ( SHORTING ) AND COVERING YOUR SHORT POSITIONS ?You will have the ability (once you open your brokerage account) to sell a stock you don't even own, and the money for the sale will show up in your account!!

What's this, you say? Sell something I don't even own?

Yes, and here is how it works: Suppose you think the ABC company is going to fall like a rock today.

You can literally call your broker and say, "I would like to

sell 300 shares of ABC short " and the broker will then place an order to sell 300 shares of ABC.

Let us assume ABC is selling for 50 dollars per share.

What is happening is that the broker will "lend" you the 300 shares of ABC to sell.

So in a few moments you find out that you have just gotten 15,000 dollars in your account.

Now if you are correct and ABC does indeed fall, you simply buy it back on the open market and give it back to the broker who loaned it to you.

This is called

covering your short.So now let us assume ABC fell to 46 dollars over the course of a few days. You buy it back at 46 and the difference between what you sold it at (50) and what you replaced it at (46) is your profit.

The key of course is being right on your assumption that ABC is going to fall, or you will end up having to buy it higher than you sold it for the purpose of replacing it with your broker.

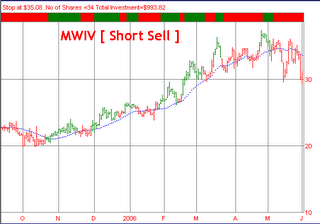

One day around mid - April 2006, you notice that when the DELL stock is at $ 28, the three conditions for SHORTING signal are fulfilled in Dreamtai:

1. Dotted Average Line Sloping down

2. Stock Price BELOW Dotted Average Line

3. Stock Price bar is RED color

You would have SHORTED DELL at $28 and then checked DELL stock chart in Dreamtai every day.

Currently, the DELL stock is around $ 24. The price bar in Dreamtai is still Red color. When the color changes to Green, you have to cover your existing short position. That is, you have to buy Dell stock to give it back to the broker who loaned it to you when you shorted the stock.

WHAT IS A STOP LOSS ORDER ?

WHAT IS A STOP LOSS ORDER ?There is a very important concept called a

"stop loss order."This is where you tell the broker that you want to attach a stop loss order on your stock and it works like a guard for you when you are away from the market.

No one picks winning trades every time, and you will not be the first. That means that you are going to buy a stock that not only doesn't rise for you, it sinks like a stone!!

If you are watching it happen you can call your broker and tell him to SELLLLL!!!!!!

But what if you are out on the lake with your kids?

A stop loss will save you from a horrible shock by selling your stock for you at a pre determined loss point.

Suppose you bought ABC with the concept that it was going to fly, but one hour after you bought the stock they released news that their Asian unit just went bankrupt?

The stock would fall like the proverbial rock, so to protect yourself we recommend using stop orders.

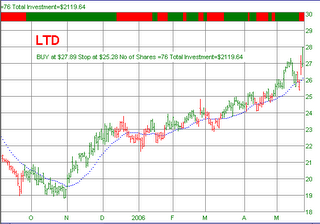

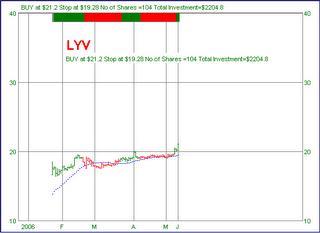

Suppose DreamTai informs you to buy (go long) 100 shares of ABC stock at price of $ 45 and stop of $42

This means you buy the stock if it goes above $ 45 and place a stop sell order of $ 42.

This means if the stock you has purchased at $45 falls below $ 42, the broker will automatically sell the stocks for you.

So, you will be protected from furthur loss if the stock goes below $ 42.

Similarly, suppose you have Shorted a stock at $25 (Sold without owning the stock)

and DreamTai tells you to place a stop order at $ 28.

You tell the broker to place a stop buy order at $28.

That means that if the stock rises above 28, the broker will buy the stock and cover your short position.

So, your maximum loss is $ 28 -$25 = $ 3 per share

(c) Dreamtai Stock Trading Software