Hers is an article about how Jim Simon, Hedge fund manager of Renaissance uses computer systems generated signals for stocks buying and selling

http://chinese-school.netfirms.com/abacus-hedge-funds-Jim-Simons.html

The file below is a PDF file

http://www.charttricks.com/Resources/Articles/jim_simons.pdf

Welcome to DreamTai Stock Trading Software blog. Here, DreamTai members can post their views, ideas, opinions and list of stocks which they like and which have given a Buy Signal or Sell signal by DreamTai stock Trading Software.

Saturday, September 30, 2006

Friday, September 29, 2006

Implementing Money Management & Trading Psychology

Here is a beautiful presentation by Bennett Mc Dowell of Traders Coach.com

Hope you find it useful.

Hope you find it useful.

| |||||

DreamTai Stock Trading Software: Friday, Sept 29, 2006

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

On Thursday, the Dow closed at 11,718 which is 29 points higher than the previous close of 11,689

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Photo credits:

chrisbernardi

Here are some stock picks:

AKAM

OMG

TRT

SWHC

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

On Thursday, the Dow closed at 11,718 which is 29 points higher than the previous close of 11,689

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Photo credits:

chrisbernardi

Here are some stock picks:

AKAM

OMG

TRT

SWHC

(c) Dreamtai Stock Trading Software

Thursday, September 28, 2006

Funny video : Stuart from Ameritrade

Remember Stuart the slacker from the Ameritrade commercials?

Here are a couple of the old commercials, and here they are for your nostalgic viewing pleasure...

CLICK HERE FOR THE VIDEOS

Here are a couple of the old commercials, and here they are for your nostalgic viewing pleasure...

CLICK HERE FOR THE VIDEOS

Tuesday, September 26, 2006

DreamTai Stock Trading Software: Tuesday, Sept 26, 2006

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

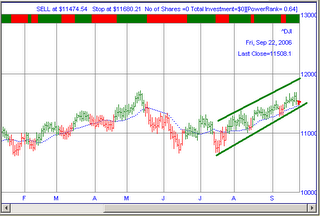

On Monday, the Dow closed at 11,575 which is 65 points higher than the previous close of 11,508

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Photo credits foshie

Here are some stock picks

AVNC

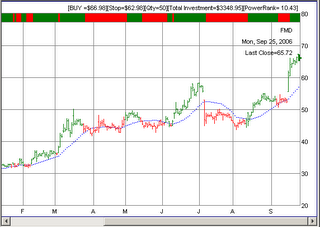

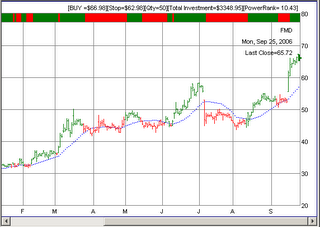

FMD

INPH

MEH

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

On Monday, the Dow closed at 11,575 which is 65 points higher than the previous close of 11,508

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Photo credits foshie

Here are some stock picks

AVNC

FMD

INPH

MEH

(c) Dreamtai Stock Trading Software

Saturday, September 23, 2006

The House That Blackjack Built

Card whiz Blair Hull parlayed a $25,000 casino stake into a Stocks and Options trading empire worth more than $500 million

Photo Credits: Spoon Monkey

Here is his advise on the subject of risk control.

Prudent money management was a skill Hull first honed on the casino floor.

To read more of it. click here ...

Photo Credits: Spoon Monkey

Here is his advise on the subject of risk control.

Prudent money management was a skill Hull first honed on the casino floor.

“No matter what, you never bet more than one fiftieth of your bankroll, and if you lose, say, half your money, you reduce your bets by half,” he says. “In the securities market, when I had a very large position and knew that we had our maximum amount of risk, I’d still be tempted to make advantageous trades that would come up. But then I’d envision chips on the table and recognize that I already had my bets on.”

To read more of it. click here ...

How Edison's nephew and his fellow scientists made MILLIONS in Gambling and Stocks

Let me tell you about three friends; Shannon, John Kelly, and Ed Thorp

Claude Elwood Shannon (April 30, 1916 - February 24, 2001):

Claude was the nephew of Thomas Edison, the inventor.

He was an American electrical engineer and mathematician, has been called "the father of information theory", and was the founder of practical digital circuit design theory.

His contributions to science are well known.

What is not well known is that he made a fortune in stock market and gambling.

He met his wife Betty when she was a numerical analyst at Bell Labs.

Shannon and his wife Betty used to go on weekends to Las Vegas with M.I.T. mathematician Ed Thorp and made very successful forays in roulette and blackjack using game theory type methods co-developed with fellow Bell Labs associate, physicist John L. Kelly . based on principles of information theory and RISK CONTROL.

Shannon and Thorp also applied the same theory, later known as the Kelly criterion, to the stock market with even better results.

Photo Credits: fancygreenbee

Edward O. Thorp

Edward Oakley Thorp (born in 1933) is a hedge fund manager, American math professor, author, and blackjack player.

He is best known for his 1962 book Beat the Dealer, which was the first book to prove mathematically that blackjack could be beaten by card counting.

He started his Las Vegas applied research using $10,000, with Manny Kimmell, a known mob associate, providing the venture capital.

The experimental results proved successful and his theory was verified since he won $11,000 in a single weekend, equivalent to $70,000 in today's dollars. Casinos now shuffle well before the end of the deck as a countermeasure.

He could have won more in his initial foray in Las Vegas save for the fact that his uncanny ability at winning drew the unwelcome attention of the casino security, mostly mob figures and that led to repeated expulsions from the various premises he visited that night.

News about the incident, even though it happened in Las Vegas, didn't stay there.

Word of the feat spread among gambling circles, always eager for new methods of winning, and Thorp became an instant, if unlikely, celebrity among blackjack aficionados.

Due to the great demand generated about disseminating his research results to a wider gambling audience he wrote the book Beat the Dealer in 1962, widely considered the original card counting manual, and which sold over 700,000 copies, a huge number for a specialty title that put it in the New York Times bestseller list, much to the chagrin of Kimmel whose identity was thinly disguised in the book as Mr. X.

Read the Beat the Dealer Book

Read Fortune's Formula Book

Read Bringing Down The House Book

Since the late 1960s he has used his knowledge of probability and statistics in the stock market and by discovering and exploiting a number of pricing anomalies in the securities markets he has made a significant fortune.

He is now president of "Edward O. Thorp & Associates" in Newport Beach and manages a hedge fund.

Princeton-Newport was Thorp's first hedge fund and it achieved an annualized net return of 15.1 percent over 19 years. In May 1998 Thorp reported that his personal investments yielded an annualized 20 percent rate of return averaged over 28.5 years.

Photo Credits: Naomi Ibuki

John Larry Kelly, Jr (1923-1965)

John Larry Kelly, Jr. was a scientist who worked at Bell Labs. He is best known for formulating the Kelly criterion, an algorithm for maximally investing money.

In 1962 Kelly created one of the most famous moments in the history of Bell Labs by using an IBM 704 computer to synthesize speech.

Apart from being a Physicist he was a recreational gunslinger and a daredevil pilot all at the same time.

He was also an associate of Claude Shannon at Bell Labs.

Kelly died tragically of a stroke on a Manhattan sidewalk at the young age of 41 in 1965. It is also reported that he never used his own criterion to make money.

The Kelly's formula

The Kelly criterion, sometimes referred to as the Kelly formula, was described in A New Interpretation of Information Rate, by J. L. Kelly, Jr, Bell System Technical Journal, 35, (1956), 917 -926, as a formula used to maximize the long-term growth rate of repeated plays of a given gamble that has positive expected value.

The formula specifies the percentage of the current bankroll to be bet at each iteration of the game.

In addition to maximizing the growth rate in the long run, the formula has the added benefit of having zero risk of ruin; the formula will never allow a loss of 100% of the bankroll on any bet. An assumption of the formula is that currency and bets are infinitely divisible, though this is met for practical purposes if the bankroll is large enough.

Click here for the link to Kelly's formula if you are interested.

DreamTai uses Kelly's formula and risks only TWO percent of the equity in a single trade to maximise profits.

Interesting links

Claude Elwood Shannon (April 30, 1916 - February 24, 2001):

Claude was the nephew of Thomas Edison, the inventor.

He was an American electrical engineer and mathematician, has been called "the father of information theory", and was the founder of practical digital circuit design theory.

His contributions to science are well known.

What is not well known is that he made a fortune in stock market and gambling.

He met his wife Betty when she was a numerical analyst at Bell Labs.

Shannon and his wife Betty used to go on weekends to Las Vegas with M.I.T. mathematician Ed Thorp and made very successful forays in roulette and blackjack using game theory type methods co-developed with fellow Bell Labs associate, physicist John L. Kelly . based on principles of information theory and RISK CONTROL.

Shannon and Thorp also applied the same theory, later known as the Kelly criterion, to the stock market with even better results.

Photo Credits: fancygreenbee

Edward O. Thorp

Edward Oakley Thorp (born in 1933) is a hedge fund manager, American math professor, author, and blackjack player.

He is best known for his 1962 book Beat the Dealer, which was the first book to prove mathematically that blackjack could be beaten by card counting.

He started his Las Vegas applied research using $10,000, with Manny Kimmell, a known mob associate, providing the venture capital.

The experimental results proved successful and his theory was verified since he won $11,000 in a single weekend, equivalent to $70,000 in today's dollars. Casinos now shuffle well before the end of the deck as a countermeasure.

He could have won more in his initial foray in Las Vegas save for the fact that his uncanny ability at winning drew the unwelcome attention of the casino security, mostly mob figures and that led to repeated expulsions from the various premises he visited that night.

News about the incident, even though it happened in Las Vegas, didn't stay there.

Word of the feat spread among gambling circles, always eager for new methods of winning, and Thorp became an instant, if unlikely, celebrity among blackjack aficionados.

Due to the great demand generated about disseminating his research results to a wider gambling audience he wrote the book Beat the Dealer in 1962, widely considered the original card counting manual, and which sold over 700,000 copies, a huge number for a specialty title that put it in the New York Times bestseller list, much to the chagrin of Kimmel whose identity was thinly disguised in the book as Mr. X.

Read the Beat the Dealer Book

Read Fortune's Formula Book

Read Bringing Down The House Book

Since the late 1960s he has used his knowledge of probability and statistics in the stock market and by discovering and exploiting a number of pricing anomalies in the securities markets he has made a significant fortune.

He is now president of "Edward O. Thorp & Associates" in Newport Beach and manages a hedge fund.

Princeton-Newport was Thorp's first hedge fund and it achieved an annualized net return of 15.1 percent over 19 years. In May 1998 Thorp reported that his personal investments yielded an annualized 20 percent rate of return averaged over 28.5 years.

Photo Credits: Naomi Ibuki

John Larry Kelly, Jr (1923-1965)

John Larry Kelly, Jr. was a scientist who worked at Bell Labs. He is best known for formulating the Kelly criterion, an algorithm for maximally investing money.

In 1962 Kelly created one of the most famous moments in the history of Bell Labs by using an IBM 704 computer to synthesize speech.

Apart from being a Physicist he was a recreational gunslinger and a daredevil pilot all at the same time.

He was also an associate of Claude Shannon at Bell Labs.

Kelly died tragically of a stroke on a Manhattan sidewalk at the young age of 41 in 1965. It is also reported that he never used his own criterion to make money.

The Kelly's formula

The Kelly criterion, sometimes referred to as the Kelly formula, was described in A New Interpretation of Information Rate, by J. L. Kelly, Jr, Bell System Technical Journal, 35, (1956), 917 -926, as a formula used to maximize the long-term growth rate of repeated plays of a given gamble that has positive expected value.

The formula specifies the percentage of the current bankroll to be bet at each iteration of the game.

In addition to maximizing the growth rate in the long run, the formula has the added benefit of having zero risk of ruin; the formula will never allow a loss of 100% of the bankroll on any bet. An assumption of the formula is that currency and bets are infinitely divisible, though this is met for practical purposes if the bankroll is large enough.

Click here for the link to Kelly's formula if you are interested.

DreamTai uses Kelly's formula and risks only TWO percent of the equity in a single trade to maximise profits.

Interesting links

- THE KELLY CRITERION IN BLACKJACK, SPORTS

- BETTING, AND THE STOCK MARKET

- by Edward O. Thorp

- Paper presented at: The 10th International Conference on

- Gambling and Risk Taking

- Montreal, June 1997

- http://www.bjmath.com/bjmath/thorp/paper.htm

- Edward O Thorp - Inventor of Card Counting in Blackjack

- http://www.blackjackhero.com/blackjack/players/edward-thorp/

DreamTai Stock Trading Software: Monday, Sept 25, 2006

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

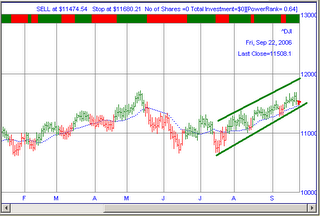

On Friday, the Dow closed at 11,508 which is 25 points lower than the previous close of 11,533

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Now, 11,300 has become the support. If the Dow tries to go below 11,300, it will face a great resistance.

If however, the market turns down so bad that it goes below 11,300 then Dow will no longer be in a bullish trend.

It will again go into sideways trend.

Photo Credit:MShades

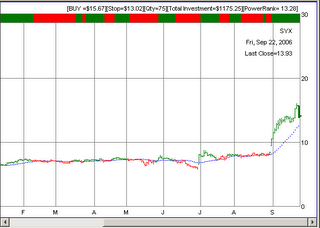

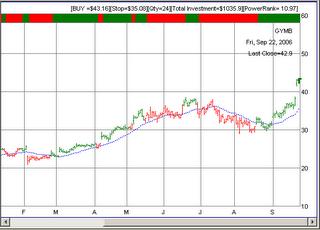

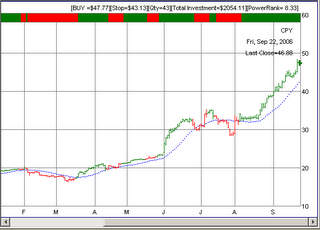

Here are some stock picks:

All are highly volatile stocks with EXTREME moves during the past year. So, try reducing the quantity of shares you trade, for these stocks.

ISIG

MDV

INPH

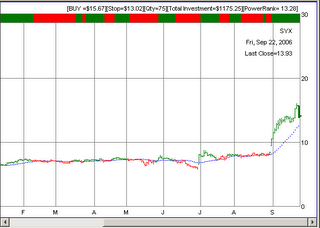

SYX

MWRK

DTLK

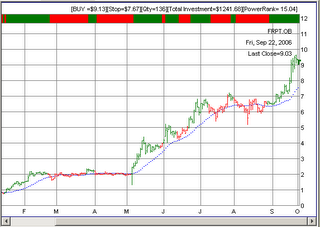

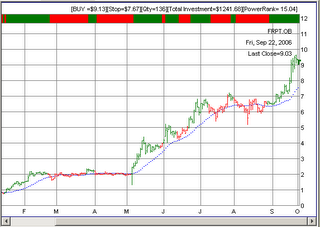

FRPT.OB

[Careful!! This is an Over The Counter stock. Usually, I do not include OTC stocks, but seeing the upward progress of this stock, I had add it ]

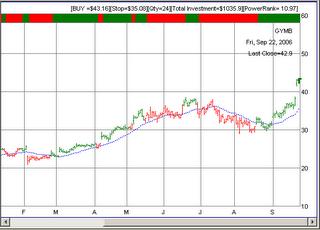

GYMB

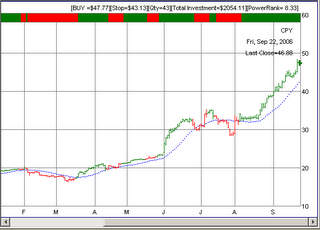

CPY

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

On Friday, the Dow closed at 11,508 which is 25 points lower than the previous close of 11,533

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Now, 11,300 has become the support. If the Dow tries to go below 11,300, it will face a great resistance.

If however, the market turns down so bad that it goes below 11,300 then Dow will no longer be in a bullish trend.

It will again go into sideways trend.

Photo Credit:MShades

Here are some stock picks:

All are highly volatile stocks with EXTREME moves during the past year. So, try reducing the quantity of shares you trade, for these stocks.

ISIG

MDV

INPH

SYX

MWRK

DTLK

FRPT.OB

[Careful!! This is an Over The Counter stock. Usually, I do not include OTC stocks, but seeing the upward progress of this stock, I had add it ]

GYMB

CPY

(c) Dreamtai Stock Trading Software

Thursday, September 21, 2006

DreamTai Stock Trading Software: Thursday, Sept 21, 2006

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

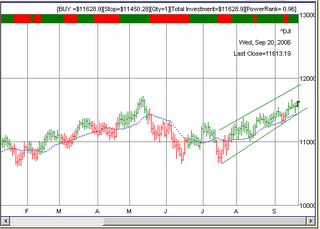

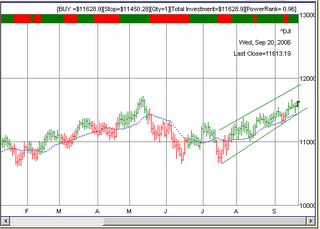

On Wednesday, the Dow closed at 11,613 which is 72 points higher than the previous close of 11,540

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Now, 11,300 has become the support. If the Dow tries to go below 11,300, it will face a great resistance.

If however, the market turns down so bad that it goes below 11,300 then Dow will no longer be in a bullish trend.

It will again go into sideways trend.

Photo credits: dipfan

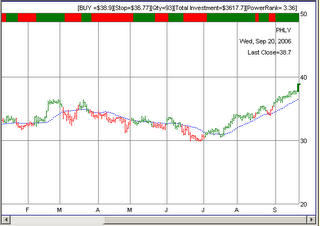

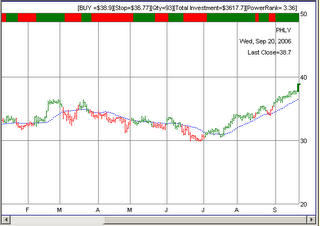

Here are some stock picks ...Careful!! They are high momentum, high volatility sizzling stocks !!

SYX

SIM

MFRI

PHLY

GIGM

MEH

(c) Dreamtai Stock Trading Software

Disclaimer: For education/entertainment purpose only. Invest at your own Risk

On Wednesday, the Dow closed at 11,613 which is 72 points higher than the previous close of 11,540

Trend is still bullish as long as it is contained in the upwards trending Bullish Channel.

Now, 11,300 has become the support. If the Dow tries to go below 11,300, it will face a great resistance.

If however, the market turns down so bad that it goes below 11,300 then Dow will no longer be in a bullish trend.

It will again go into sideways trend.

Photo credits: dipfan

Here are some stock picks ...Careful!! They are high momentum, high volatility sizzling stocks !!

SYX

SIM

MFRI

PHLY

GIGM

MEH

(c) Dreamtai Stock Trading Software

Subscribe to:

Comments (Atom)