Hi Prasan,

Thanks again for sharing these with the members.

All members, please feel free to add your comments, opinions and questions.

IHR

Beautiful uptrending stock with power ranking= 7.15

I would buy it

LNUX

No action at present.

Power ranking = -2.38

Not bearish enough

It should be below -5 to be significant

AMKR

No action at present.

Power ranking = -1

Not bearish enough

It should be below -5 to be significant

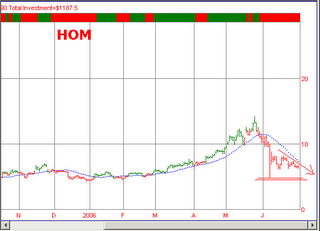

HOM

Bearish Power Ranking=12

May short it below 4.79

Currently it is just chopping around in a triangle pattern.

NXG

No action at present.

Power Ranking=2.04 which is weakly bullish

May Buy it after it crosses 4.82

JSDA

No action at present.

May short it below 8.42 after it goes below the triangle pattern

Power ranking is -4.3 which is not much. It should be below -5 to be significant